nassau county tax rate per $100

Suffolk County New York sales tax rate details The minimum combined 2021 sales tax rate for Suffolk County New York is 863. Multiply retail price by tax rate Lets say youre buying a 100 item with a sales tax of 5.

1 Nassau County Department Of Assessment Unfair School Property Tax System Is It Time For An Income Tax Presented By Harvey B Levinson Chairman Board Ppt Download

The existing property tax rate was 074212 per 100 valuation which is what the rate has been for six years.

. 0648979 per 100 taxable value. Under the new tax rate the. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality.

Nassau County Florida has a 6 sales tax and additional local option taxes which can raise the sales tax rate to up to 75. The Nassau Bay City Council unanimously approved the fiscal year 2023 tax rate at 0648979 per 100 of valuation at a special Sept. Presumably a tax rate of 2000 per 100 of assessed value would bring your taxes to a total of 15000.

Nassau County Bd of Assessors chmn Abe Seldin repts countys avg school tax rate for 7475 is 91 above last yrs figure. The Fiscal Year 2022 Budget is scheduled for adoption on September 13 2022 and the corresponding Tax Year 2021 tax rate is scheduled for adoption on September 27 2021. Nassau county tax rate per 100.

The Nassau County sales tax rate is. Adopted FY23 Tax Rate. The median property tax in Nassau County is.

With the same 2000 tax rate per 100 900000 x 0001 the. Tax Value 7525 - 700 525. In Nassau County the median property tax bill is 14872 according to state.

Click here for a Five Year History of Nassau. This is the total of state and county sales tax rates. What is Nassau Countys tax rate.

Per New York State law a homes assessed value cannot be increased by more than 6 per. What is New York state tax. The New York state sales tax rate is currently 4.

Are there restrictions on the relief requested in Small Claims. Tax rate is based on each 100 of assessed valuation. The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use Tax of 8875 percent.

The Citys Fiscal Year 2023 FY23 corresponds with Tax Year 2022. Your math would be simply. The Nassau County Clerk collects a 30 fee for New York State.

With the new assessments in place the same home will have a market value of. 2021 tax rates per 100 value for entities collected by aransas county tax assessor-collector entity total rate gar - aransas co advalorem. Cost of the item x percentage as a decimal sales tax.

54 rows Tax Rate. A rate per one hundred dollars of assessed value expressed in dollars and. This is the total of state and county sales tax rates.

You may not claim a reduction greater than that requested in. Nassau County New York sales tax rate details This is the total of state and county sales tax rates. What is 700 tax.

Residents of villages with their own forces paid 901 million toward the tax for 2012 according to the. For 2012 the tax rate was 49347 per 100 of assessed valuation. Suffolk County New York sales tax rate details The minimum combined 2021 sales tax rate for Suffolk County New York is 863.

The Nassau County sales tax rate is 425. Click here for a Five Year History of Nassau Bays Tax.

Understanding Your Nassau County Assessment Disclosure Notice

Blog Nassau County Chamber Of Commerce

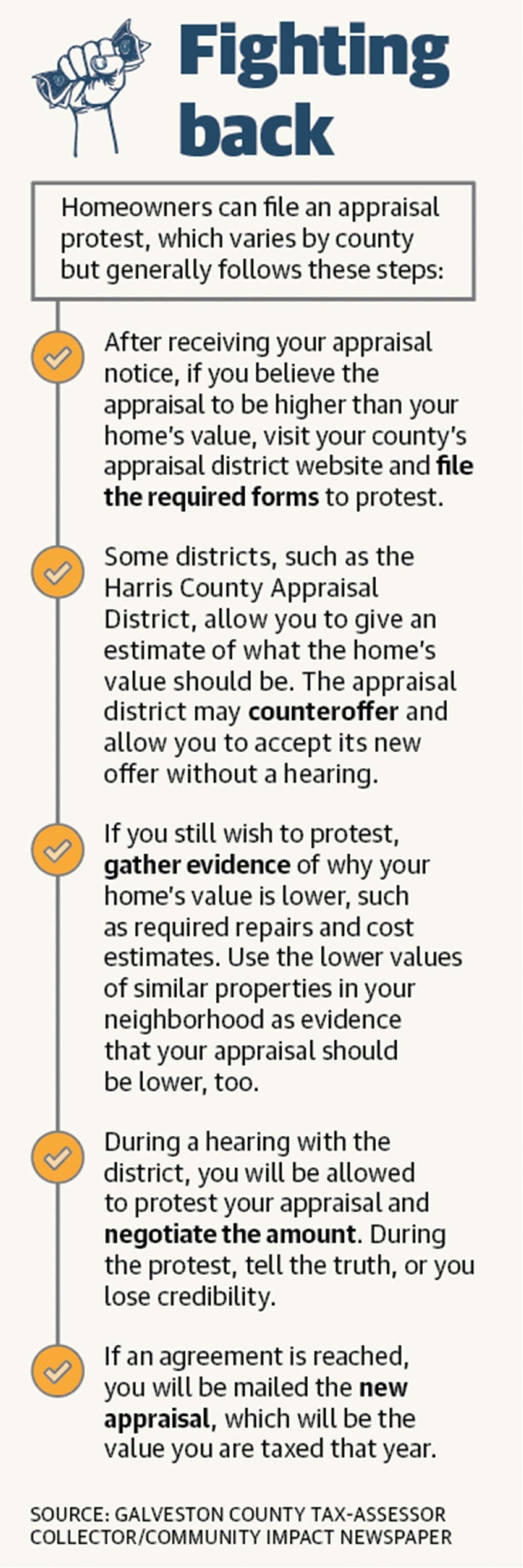

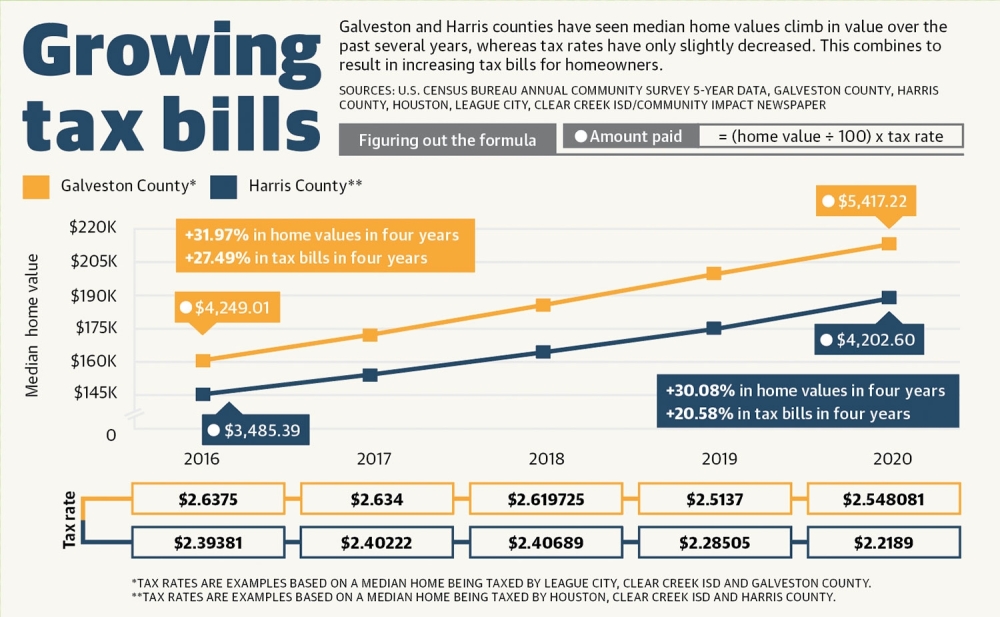

Officials Fight For Reform As Property Values Skyrocket Community Impact

Harris County Commissioners Court Sept 13 Preview Public Hearings Vote On Tax Rate And Budget Community Impact

Economy In Nassau County New York

Massapequa Politics Government News Massapequa Ny Patch

Re Elect Legislator Howard J Kopel

Filing Fees Nassau County Clerk Of Courts And Comptroller

Economy In Nassau County New York

The Nassau County School Superintendent Is Stonewalling And Taxpayer Watchdog Group Is Told To Go Pound Sand Dave Scott Blog

Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance

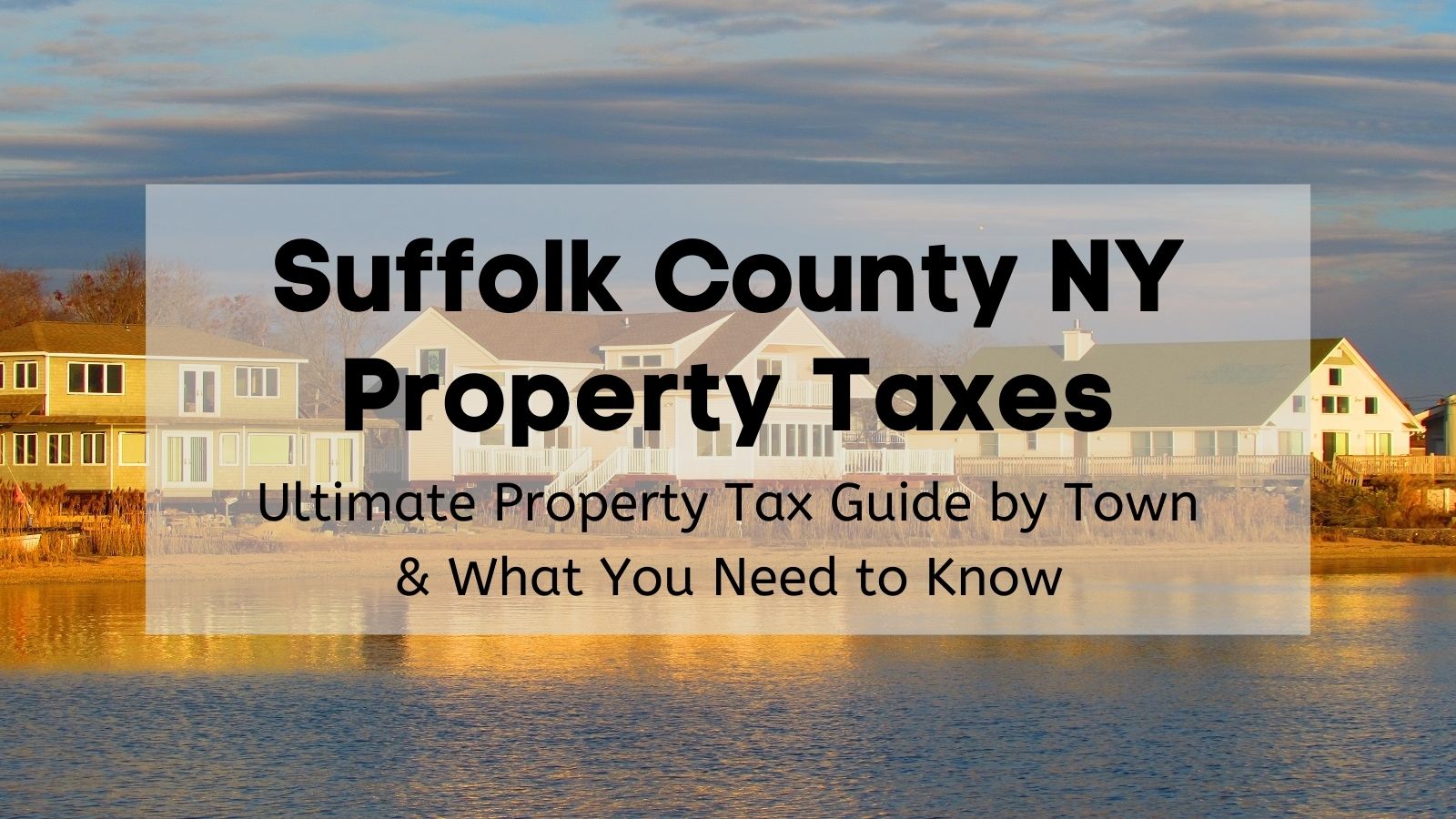

Suffolk County Ny Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

1 Nassau County Department Of Assessment Unfair School Property Tax System Is It Time For An Income Tax Presented By Harvey B Levinson Chairman Board Ppt Download

Filing Fees Nassau County Clerk Of Courts And Comptroller

Harris County Commissioners Set Stage For Tax Rate Vote Community Impact

Officials Fight For Reform As Property Values Skyrocket Community Impact

Nassau Bay Lowers Tax Rate Effectively Increases Tax Income Slightly Community Impact